Dreaming of studying in Singapore? Good news: with the right planning, you can enjoy a safe, high-quality education and vibrant lifestyle without financial stress.

The cost of living in Singapore ranges from SGD 1,900 – SGD 3,200 per month (approximately ₹1,29,200 – ₹2,17,600). While this is higher than in India, a well-structured budget and smart choices make life affordable, and the long-term ROI on education and career opportunities is substantial (The Economic Times). As of September 2025, over 8,000 Indian students are pursuing studies in Singapore, a 38% increase from previous years. The city-state is globally recognised for its safety, excellent education, and career-ready opportunities.

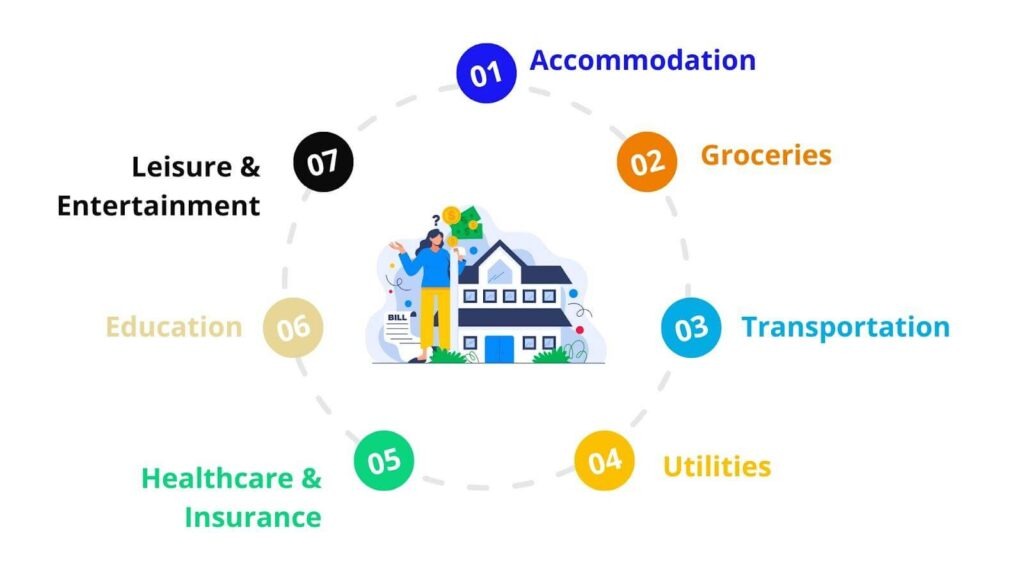

In this guide, we’ll break down everything you need to know for 2026, from accommodation, food, transport, and healthcare costs to budgeting tips, so you can plan your Singapore journey with confidence and clarity.

Average Cost of Living in Singapore for Indian Students 2026

The monthly Singapore living expenses per month depend on your lifestyle, accommodation, and study choice. Here’s an approximate monthly cost for a single student:

Choose your dream country

When do you want to study abroad?

What's your highest level of education?

Select you current city

How Leap will help you

Personalised University Shortlist

Express Applications with Quicker Admits

End-to-End Application Support

| Expense Category | Est. Monthly Cost (SGD) | Est. Monthly Cost (INR) |

|---|---|---|

| Accommodation (Shared Room) | $700 – $1,200 | ₹47,600 – ₹81,600 |

| Food (Groceries + Hawker Centres) | $450 – $700 | ₹30,600 – ₹47,600 |

| Public Transport (MRT/Bus) | $100 – $150 | ₹6,800 – ₹10,200 |

| Utilities (Shared Bill) | $80 – $150 | ₹5,440 – ₹10,200 |

| Phone Bill & Personal Needs | $50 – $100 | ₹3,400 – ₹6,800 |

| Total (Estimated) | $1,380 – $2,200 | ₹93,840 – ₹1,49,600 |

1. Accommodation in Singapore per Month

Students can choose on-campus housing, HDB flats, or private apartments. Accommodation is usually the largest part of a student’s budget. Options include:

- On-Campus Housing: SGD 500 – 800 (₹34,000 – ₹54,400) per month. Most top universities in Singapore provide dormitories that include basic amenities, Wi-Fi, and meal options. These are convenient and generally more affordable than private accommodations.

- Private Studio/Apartment: SGD 1,000 – 1,200 (₹68,000 – ₹81,600) per month. Offers privacy, kitchen facilities, and flexibility, but costs are higher.

- Shared Apartment (2–3 roommates): SGD 700 – 900 (₹47,600 – ₹61,200) per person per month. Sharing reduces rent and utility costs while providing more independence than campus housing.

Sharing apartments with roommates can save up to 30–40% on accommodation costs.

2. Food Expenses in Singapore

Singapore’s food prices are higher than in India due to imports, but students can manage costs with a mix of home-cooked meals and affordable dining:

- Hawker Centre Meals (Street Food): SGD 4 – 8 (₹272 – ₹544) per meal. Affordable, authentic, and a great way to experience local cuisine.

- Mid-Range Restaurants: SGD 15 – 30 (₹1,020 – ₹2,040) per meal. Use occasionally for variety.

- Groceries for Home Cooking: SGD 300 – 450 (₹20,400 – ₹30,600) per month. Includes essentials like rice, vegetables, dairy, and meat.

Shopping at local wet markets and supermarket chains like NTUC FairPrice, Giant, and Sheng Siong can lower grocery expenses..

3. Transportation Costs in Singapore

Singapore’s public transport is efficient, reliable, and affordable. Singapore’s transport system is highly efficient, making daily commuting affordable:

- Monthly Student Concession Pass: SGD 100 – 150 (₹6,800 – ₹10,200). Unlimited travel on MRT trains and buses.

- Occasional Taxis/Grab Rides: SGD 10 – 20 (₹680 – ₹1,360) per ride. Best used for convenience or late-night travel.

Owning a car is extremely costly in Singapore (taxes, insurance, parking). Public transport is the most practical option for students.

4. Other Expenses: Utilities, Phone & Miscellaneous Costs

Besides accommodation, food, and transportation, students in Singapore should budget for miscellaneous monthly expenses (unavoidable for lifestyle and personal expenses), which include utilities, communication, and personal needs. Here’s a detailed breakdown:

Utilities cover electricity, water, gas, and internet. Costs vary depending on apartment size, usage, and whether bills are shared:

- Electricity + Water: SGD 50 – 100 (₹3,400 – ₹6,800)

- Gas (if cooking at home): SGD 20 – 40 (₹1,360 – ₹2,720)

- Internet: SGD 30 – 50 (₹2,040 – ₹3,400)

Sharing utility bills with roommates significantly reduces monthly expenses. Energy-efficient habits like switching off unused appliances and limiting AC use can save up to 20–30% of utility costs.

2. Phone Bill & Internet:

Students need a mobile plan for calls, texts, and internet access. Options include:

- Prepaid/Postpaid Mobile Plan: SGD 25 – 50 (₹1,700 – ₹3,400)

- Mobile Data / Top-ups: Included in most plans; ensure sufficient data for online classes and social apps

3. Personal Care & Miscellaneous:

Other day-to-day expenses can add up and include:

- Toiletries & Personal Care: Shampoo, soap, dental care, etc.

- Laundry / Dry Cleaning: SGD 20 – 50 (₹1,360 – ₹3,400) per month

- Stationery / Study Supplies: SGD 10 – 30 (₹680 – ₹2,040)

- Entertainment & Leisure (Optional): SGD 50 – 100 (₹3,400 – ₹6,800) for movies, sports, hobbies, or occasional outings

Planning for miscellaneous expenses ensures you won’t be caught off guard, keeping your budget realistic and stress-free.

One-Time & Academic Costs for Indian Students

Beyond the monthly costs, there are the costs of studying in Singapore. This is the main investment in your child's future.

Here is a more accurate breakdown of the true one-time costs for parents' planning:

| One-Time Cost | Approx. Cost (SGD) | Approx. Cost (INR) | Mentor's Note (What is this for?) |

|---|---|---|---|

| University Application Fees | $20 – $100 (per uni) | ₹1,360 – ₹6,800 | This is the non-refundable fee you pay just to apply to each university (like NUS, NTU, etc.). |

| Student's Pass (Visa) Fees | $90 – $150 | ₹6,120 – ₹10,200 | This is paid to Singapore's Immigration & Checkpoints Authority (ICA). It includes the application fee (S$30-S$45) and the issuance fee (S$60-S$90) after approval. |

| Accommodation Deposit | $700 – $2,400 | ₹47,600 – ₹1,63,200 | This is the biggest upfront cost. Landlords require a security deposit (usually 1-2 months' rent), which you get back at the end of your lease. |

| In-Singapore Medical Check-up | $50 – $100 | ₹3,400 – ₹6,800 | Once you arrive, you must complete a medical exam in Singapore to finalize your Student's Pass. |

| One-way Flight to Singapore | $250 – $500 | ₹17,000 – ₹34,000 | This varies greatly depending on when you book and from which Indian city you are flying. |

| Settling-In Costs | $200 – $400 | ₹13,600 – ₹27,200 | Budget for things you'll need to buy on arrival: bedding, a SIM card, kitchen items, and power adapters. |

Always check the specific course page on the university website for the exact 2026 intake fees. The fee after scholarships in Singapore for public universities (like NUS, NTU) applies to international students and makes tuition much more affordable.

Tips to Reduce the Cost of Living in Singapore

1. Accommodation

- Share a 2–3 bedroom HDB or private apartment with roommates to cut rent by 30–40%.

- Consider neighbourhoods like Jurong, Woodlands, or Tampines, which are well-connected but cheaper than the city centre.

- Use rental comparison platforms like 99.co, PropertyGuru, or SRX Property to find the best deals.

2. Groceries & Food

- Shop at wet markets or Sheng Siong, NTUC FairPrice, and Giant for affordable fresh produce.

- Use grocery delivery apps like HappyFresh or RedMart to compare prices and save on transport.

- Eat at hawker centres for SGD 4–6 (₹272–₹408) per meal instead of dining at restaurants daily.

3. Transportation

- Purchase a monthly student concession pass (SGD 100–150 / ₹6,800–₹10,200) for unlimited MRT and bus rides.

- Use bike-sharing services like Anywheel, SG Bike, or Mobike for short trips under 5 km.

- Avoid owning a car due to high COE, insurance, parking, and maintenance costs.

4. Utilities & Internet

- Switch off the AC, lights, and electronics when not in use to save electricity.

- Share internet plans among roommates to reduce costs (SGD 30–50 / ₹2,040–₹3,400).

- Compare mobile plans from Singtel, StarHub, or M1 to choose the most affordable prepaid/postpaid plan.

5. Healthcare & Insurance

- Opt for public hospitals and polyclinics for basic consultations (SGD 50–100 / ₹3,400–₹6,800).

- Buy student health insurance plans to cover unexpected medical costs.

- Use preventive care services, such as free vaccinations and screenings, offered by the government.

6. Education & Learning

- Apply for scholarships or bursaries offered by universities and private institutions.

- Consider online courses and certification programs to supplement learning without extra tuition costs.

- Indian students on a budget can explore local government schools or universities for lower tuition fees.

7. Entertainment & Leisure

- Visit free or low-cost attractions like the Botanic Gardens, East Coast Park, or public museums.

- Host potlucks or study group meals instead of frequent dining out.

- Use Netflix, Spotify, or YouTube for affordable entertainment instead of cinema or live shows.

8. Dress & Personal care

- Buy daily essentials, toiletries, and personal care products from supermarkets like NTUC FairPrice, Giant, or Watsons to save money.

- Budget for laundry, grooming, and personal care items, which typically cost around SGD 20–50 (₹1,360–₹3,400) per month

- Do thrifting for clothes items, especially for the seasonal ones

Conclusion

Living in Singapore as an Indian student is more than just managing expenses; it’s an investment in your future. While the city’s cost of living is higher than in India, careful budgeting, shared accommodation, smart food choices, and efficient public transport make it manageable. Singapore offers world-class education, strong career opportunities, and a safe, vibrant lifestyle.

Start planning your move today, research universities, explore scholarships, and create a realistic budget to make the most of your student experience in Singapore. Don’t wait, your Singapore study journey can begin now. Talk to Leapscholar counsellors for guidance.

Frequently Asked Questions (FAQs)

-

How much salary do I need to live in Singapore?

A single student or expat should plan for SGD 1,900 – 3,200 per month (₹1,29,200 – ₹2,17,600) depending on lifestyle and accommodation.

-

Is Singapore expensive to live in?

Yes, Singapore is more expensive than India, especially for accommodation and imported food, but public transport, healthcare, and utilities are affordable relative to its quality of life.

-

Is 7,500 SGD a good salary in Singapore?

Yes, a monthly salary of SGD 7,500 (₹5,10,000) is comfortable for a single person, covering rent, food, transport, and leisure with savings potential.

-

Is 3,000 SGD enough in Singapore?

For a single student or expat, SGD 3,000 (₹2,04,000) per month is sufficient if living frugally with shared accommodation, cooking at home, and using public transport.

-

What jobs are in demand in Singapore?

Technology, healthcare, finance, data analytics, and engineering sectors are currently in high demand.

-

Is Singapore costlier than India?

Yes, the cost of living in Singapore is higher than in India, especially for rent, imported food, and leisure activities.

Have Questions? Get Guidance to reach your Dream University

Connect with India's finest counsellors and biggest study abroad community.

Get Guidance